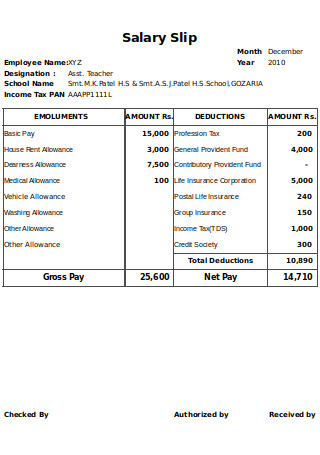

While every company has to provide you Pay Slips, few companies even offer a print of payslip to their employee or email salary slip in PDF format to their employees so that we can download the payslip anytime. That’s why according to law, it is your right to ask for the Pay Slip if your company is not issuing it. The employee Salary Slip is a very important legal document proof for his earnings. are exempt from the tax deductionĪdditionally, Payslip is very important for applying credit card, loans, mortgage of houses and the government benefits such as tax benefits, subsidy and medical benefits. It helps you to understand and handle your money. A payslip is an essential record of your employment. Telephone bills reimbursement, Medical reimbursements etc. DecemIf you are an employee or have been in the past, definitely you would have come across a payslip or payslip template at some point of your life.Performance Bonus and Special Allowance.Income(Gross Salary + Other Income) – DeductionsĬTC= Total salary package of the employeeīasic Salary + HRA + Allowances – Income Tax – Employer’s Provident Fund – Professional Tax

It can help to calculate the Gross earnings and deductions. Here we prepared few Salary Slip Excel Formats with predefined formulas. Most people find a salary receipt essential only when applying for a loan or a new credit card.

Hence, the document is proof of the salary payments made from the payroll transition and process.

The format of Payslip consists of all earnings (fixed and variable) and deductions (fixed and variable) along with the mandatory tax deductions like TDS and FBT. Employees can download them in a PDF format and use them to compute their monthly budget.

0 kommentar(er)

0 kommentar(er)